are union dues tax deductible in ny

The FY 2018 Enacted Budget creates a union dues deduction for New York taxpayers who itemize deductions at the state level equal to the amount currently disallowed at the federal level due. In the new state budget agreement unions lobbied for and won a provision that will allow private- and public-sector union members to deduct the cost of their union dues from their New York.

As a result of legislation championed by NYSUT the state AFL-CIO and unions across the state which was passed and signed into law.

. In a first of its kind move New York law makers have made union dues fully tax deductible. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business. Just a reminder that as you complete your tax forms for New York State if you itemize your tax deductions be sure to include your.

The new measure was signed by New York Governor Andrew Cuomo. My apologies I think I misinterpreted your initial question. Reminder Union Dues are Tax Deductible.

Union dues will be entered into the Federal portion of TurboTax and then they will automatically transfer over to. Four years have passed since union dues havent been deducted from federal taxes and many lawmakers are attempting to bring it back and make it deductible without itemizing. Union Dues To Be Deductible From New York State Taxes Spivak Lipton Llp Thanks to new legislation union members can now deduct their union dues in full from their.

California along with other states including Pennsylvania and New York already allows union members to lower their taxable income by the amount of their union dues through. New York Makes Union Dues Tax Deductible. Two years ago the New York State AFL-CIO along with unions across the State of New York fought for legislation that would allow union members to deduct union dues on state income.

No employees cant take a union dues deduction on their return. Unfortunately while union dues are technically 100 deductible this year they are only such if you Itemize your returns on your New York state return. If your Standard Deduction.

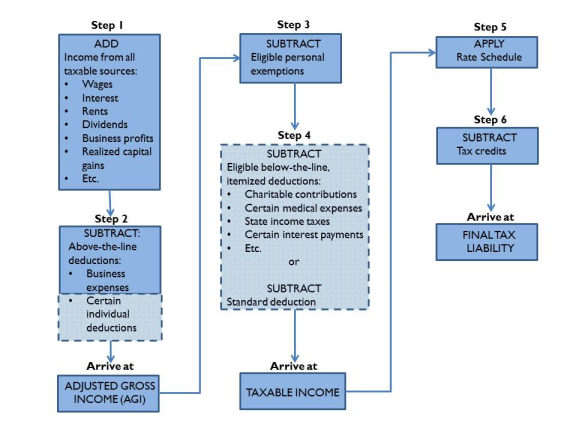

In the late-hour last-minute haggling that often defines New Yorks state budget negotiations Gov. State tax deduction for your union dues. The TCJA made union dues non-tax deductible Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses.

Hey Union Dues Are Now Tax Deductible Lut Levittown United Teachers

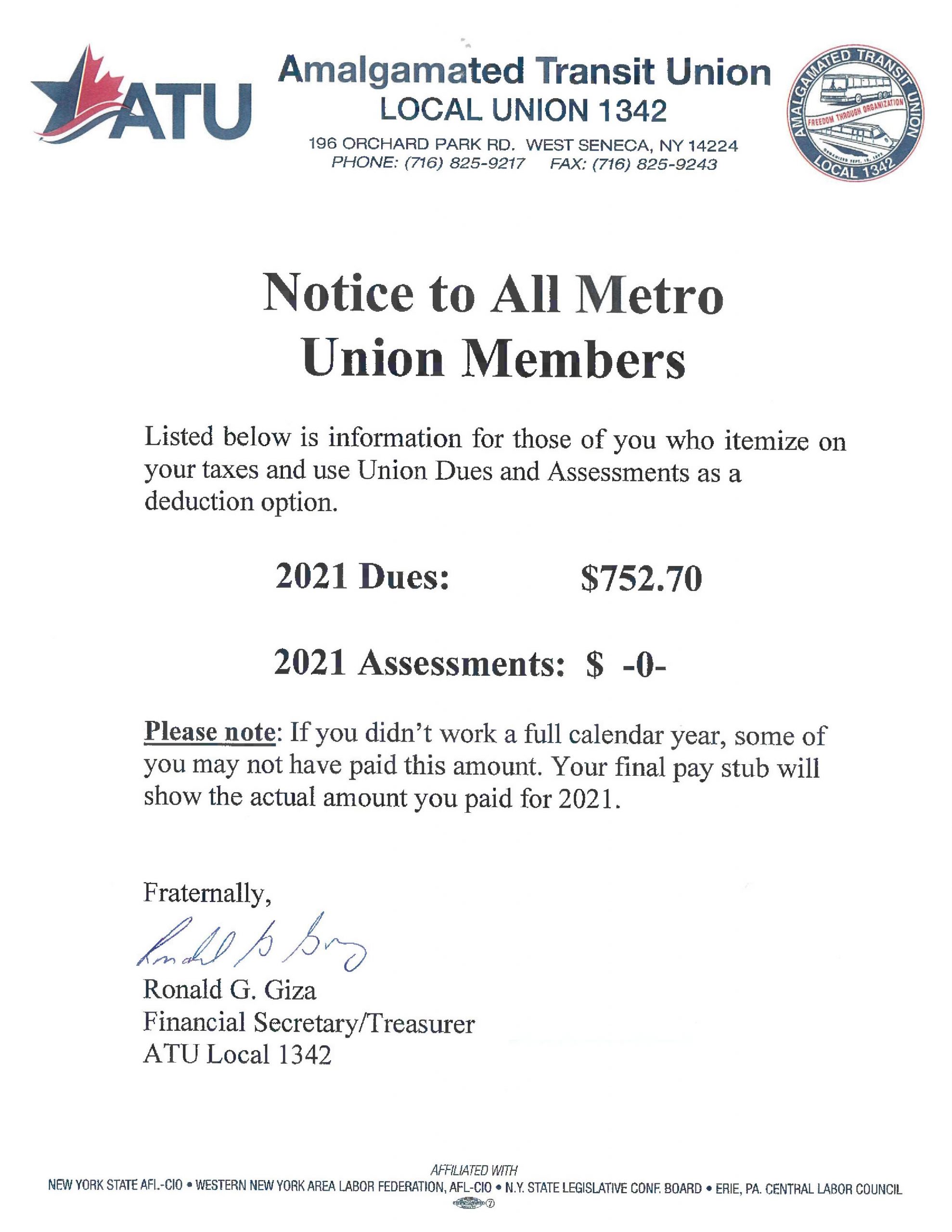

2021 Atu Final Dues Numbers Atu Local 1342

Business Deductions Cover A Broad Range The New York Times

The Union League Club 1863 2013 By Secret Agency Group Issuu

Paycheck Deductions In New York Ricotta Marks L L C

Union Dues Are Now Tax Deductible Ibew 1249

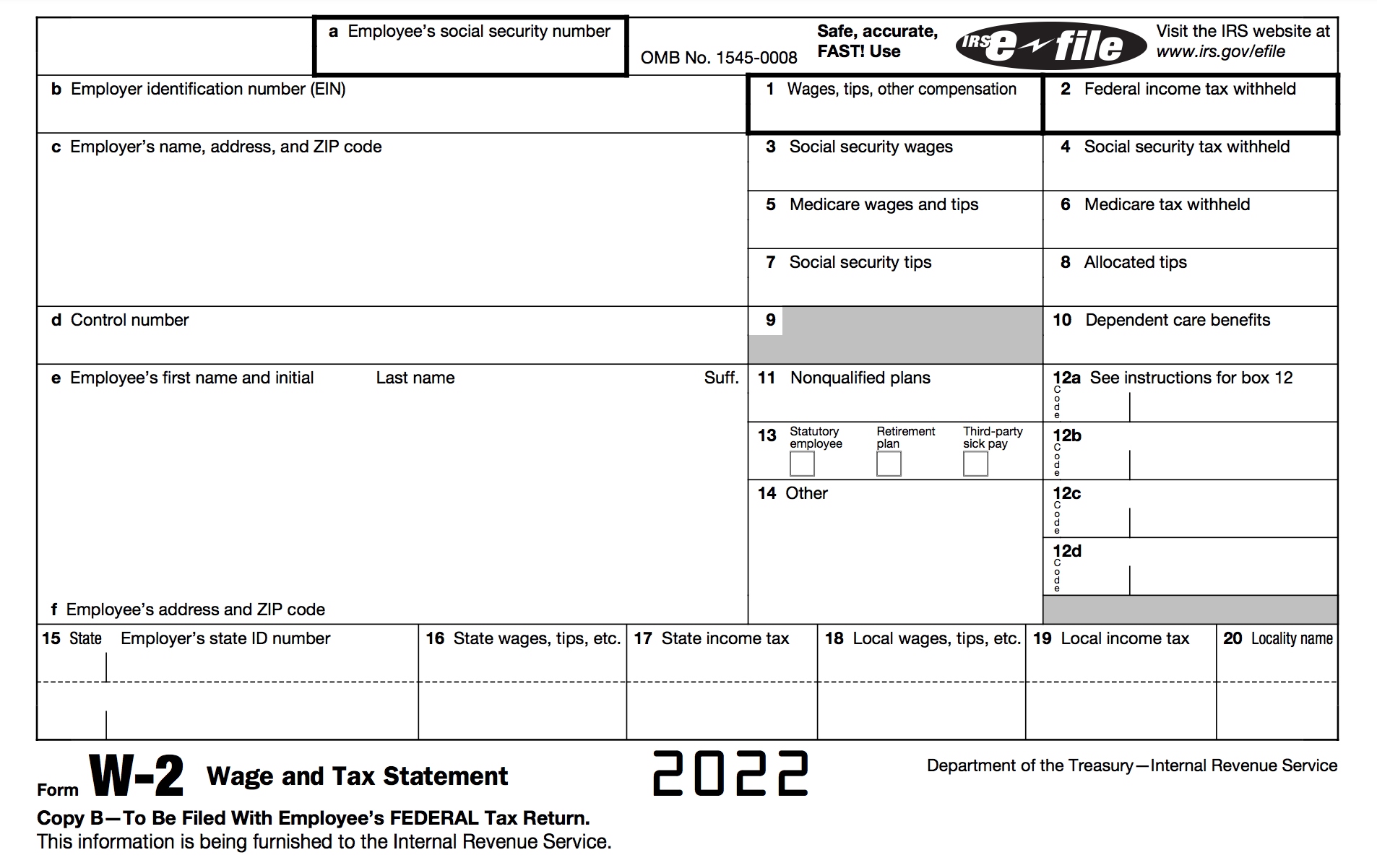

How To Fill Out A W 2 Tax Form For Employees Smartasset

Nys Afl Cio Union Dues Now Deductible From State Income Taxes Twu Local 100

Solved Can We Still Deduct Electrical Union Dues And The Additional Work Assessment Fees That We Used To Itemize On Either Our Federal Return Or On The Minnesota Return

Tax Deductions For Individuals A Summary Everycrsreport Com

How To Fill Out Your Tax Return Like A Pro The New York Times

Cuomo Signs Legislation Allowing Full Union Dues To Be Deducted From Taxes New York Amsterdam News

Become A Member Nyc Council Union

The Wandering Tax Pro What S New For 2018 Tax Forms New York

Deducting Union Dues H R Block

Democrats Want New Tax Break For Union Members National Review

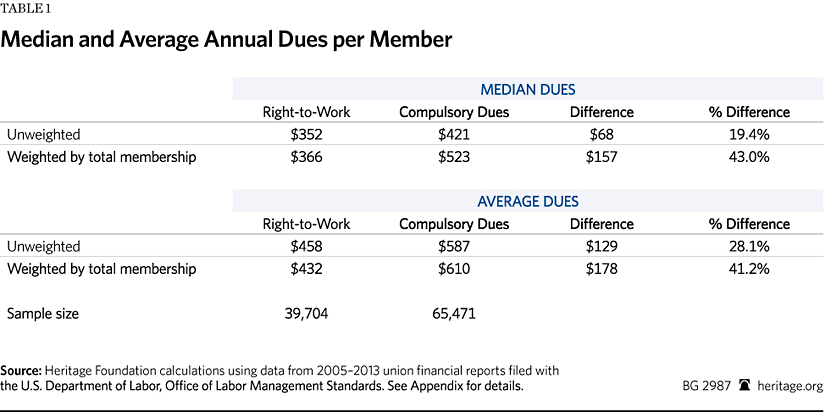

Unions Charge Higher Dues And Pay Their Officers Larger Salaries In Non Right To Work States The Heritage Foundation

Ny S New Tax Break For A Few Empire Center For Public Policy