Bank of England base rate

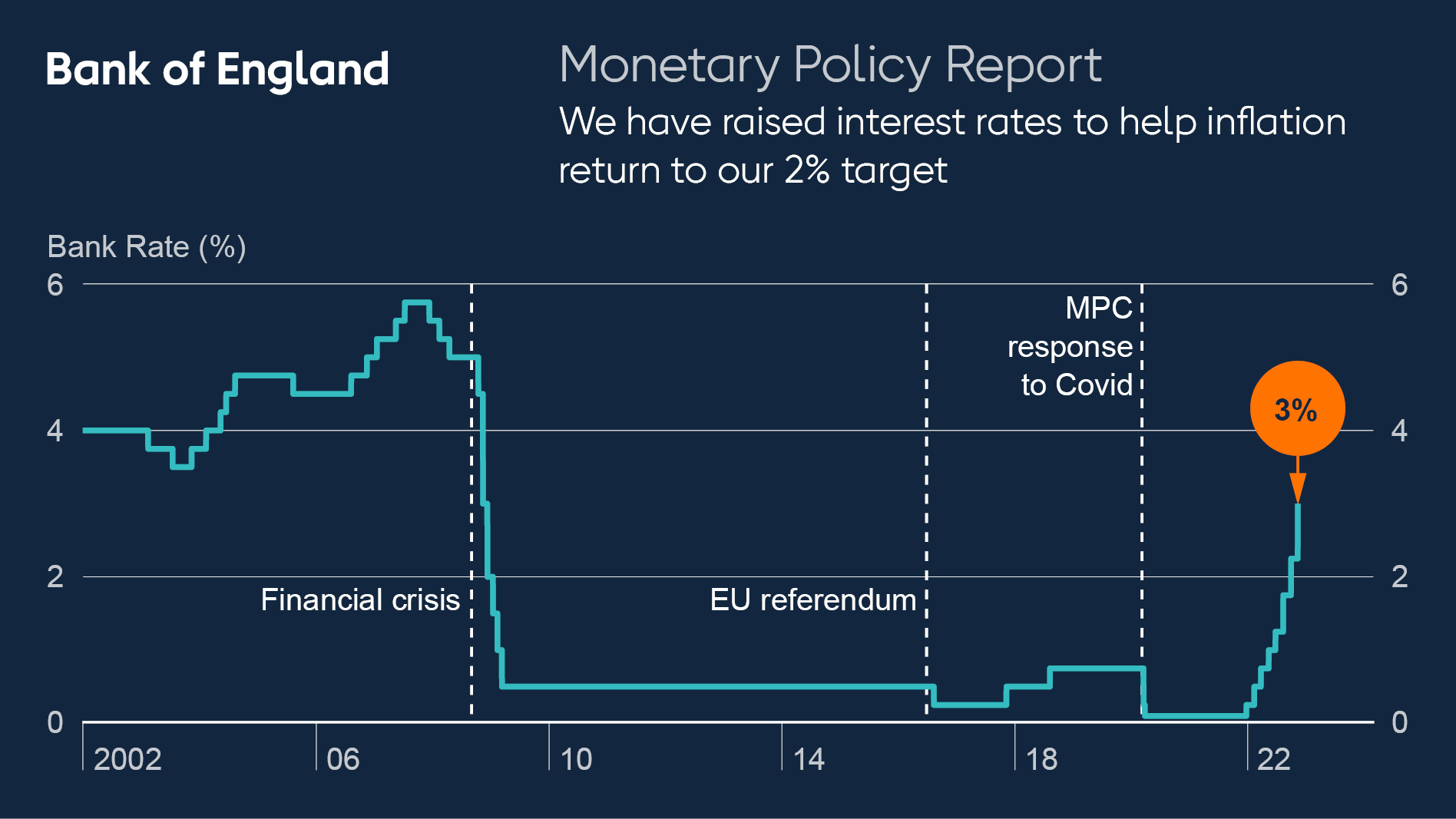

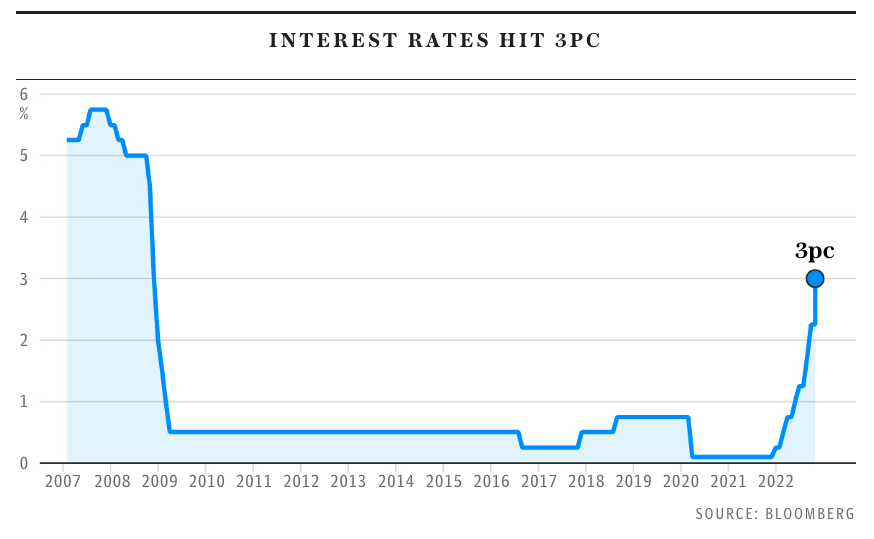

The current Bank of England base rate is three per cent. Bank of England ups base rate to 3 - the biggest rise for more than 30 years.

This rate is used by the central bank to charge other banks.

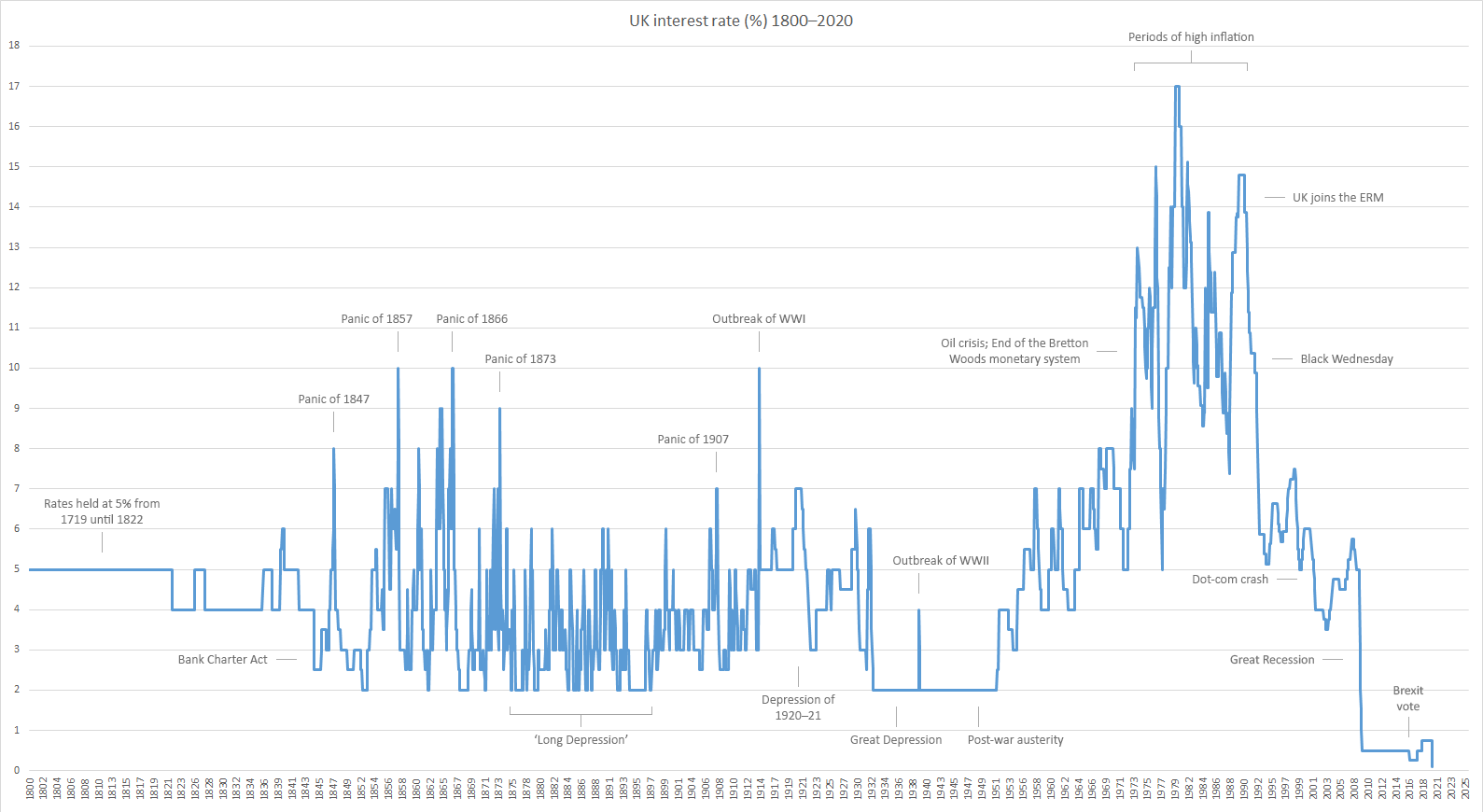

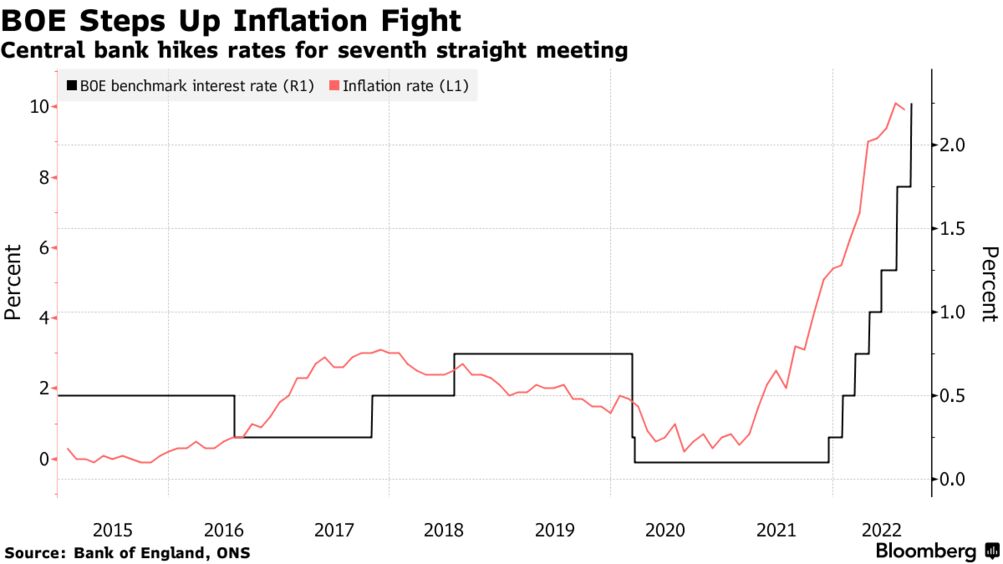

. Earlier today the Bank of Englands Monetary Policy Committee MPC met to discuss the UKs base rate. Over the last couple of months the central bank has consecutively raised. The Bank of England has unveiled a 075 interest rate rise - the biggest since the 1980s - in a bid to control the runaway inflation.

Threadneedle Street London EC2R 8AH. What the 075 interest rate hike means for your mortgage and savings. Daily spot rates against Sterling.

Our mission is to deliver monetary and financial stability for the people of the United Kingdom. MAJOR banks have cut mortgage bills for some customers - despite the Bank of England hiking interest rates. If you have a problem or question relating to the database please contact the DSD EditorReference Id 16308164031.

The current Bank of England base rate is 225. The base rate was previously reduced to 01 on 19. Continue reading to find out more about how this could affect you.

The Base Rate is the interest rate set by the Bank of England and is also known as the official Bank Rate. 3 November 2022 The Bank of England has increased the base rate from 225 to 3 the largest single rise since 1989. HMRC interest rates are linked to.

This Bank of England interest rate decision was announced after the Monetary Policy Committee meeting on 3 November. Daily spot exchange rates against Sterling. The Bank of England base rate is currently 225.

Despite the Bank of England increasing the base rate of interest by 075 percentage points - the biggest hike since 1989 - lenders may now cut the cost of mortgages for some. The central bank raised its base rate of interest yesterday by 075. That was the message.

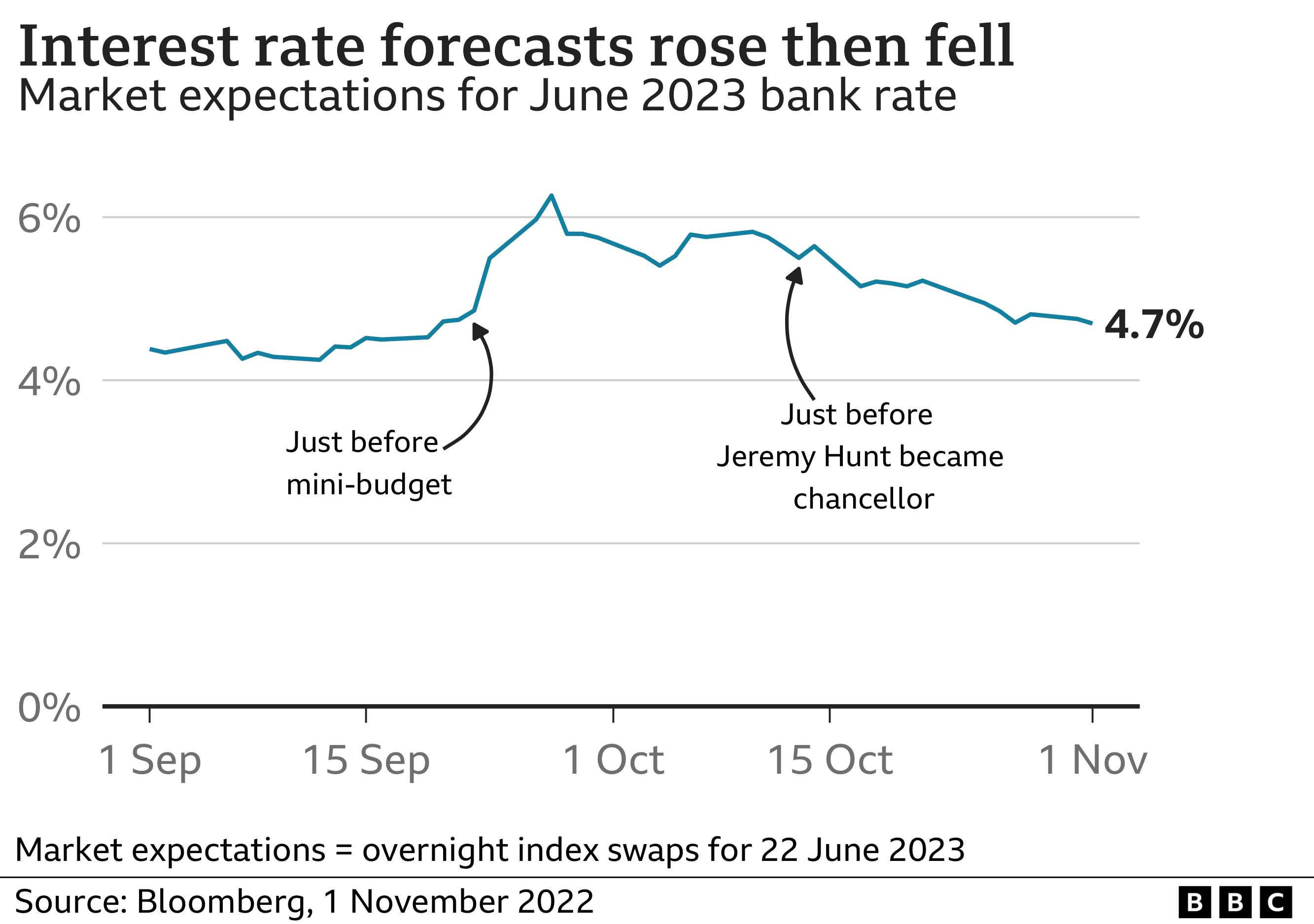

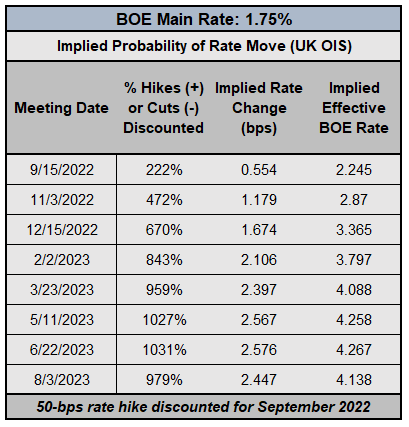

One of the Banks deputy governors Ben Broadbent said the rise in rates priced in by markets from 225 now to 525 over the coming months was not a foregone. 47 rows The Bank of England BoE base rate is often called the interest rate or Bank Rate. The Bank of England Monetary Policy Committee voted on 4 August 2022 to increase the Bank of England base rate to 175 from 125.

The Bank of England BoE is the UKs central bank. 3 Current Bank Rate Next due. The base rate was increased from 175 to 225 on 22 September 2022.

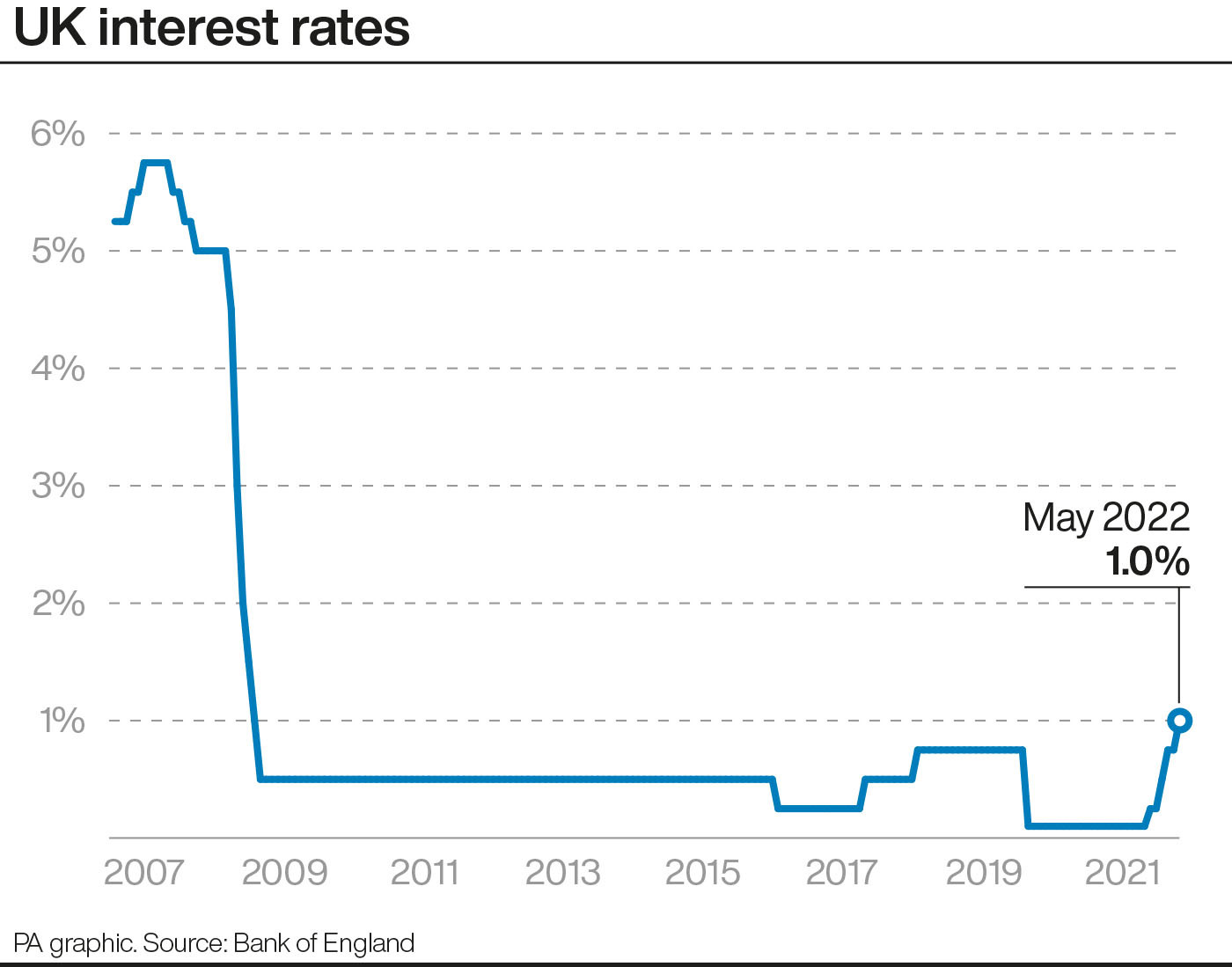

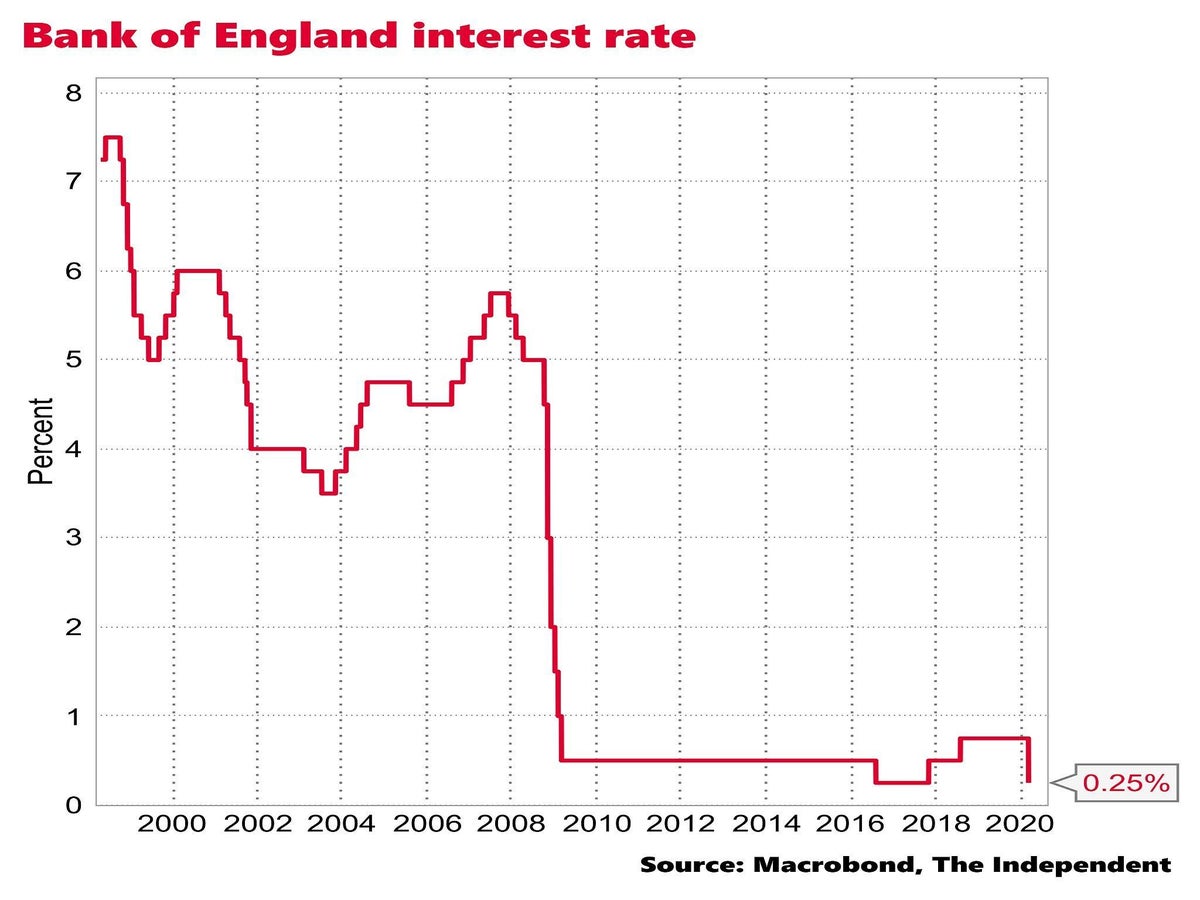

The base rate dropped to an all time low of 01 following the outbreak of the coronavirus pandemic in March 2020. Our use of cookies. It could rise to 075 in 2022 bringing it back to pre pandemic levels.

The Bank of England base rate is currently. It sees the Banks base interest rate rise from. 3 despite a plummet in sterling but will make big moves in November.

15 December 2022 101 Current inflation rate Target 2 Monetary Policy Report - November 2022 Our quarterly Monetary Policy Report sets out the. The Bank of England wont raise interest rates before its next scheduled policy announcement on Nov. 025 The bank rate was raised in November 2021 to 025.

Interest rates have risen to their highest level in more than a decade but probably wont go much higher than 3. Last modified on Thu 3 Nov 2022 1707 EDT. Bank Rate increased to 225 - September 2022 Bank of England Home Bank Rate increased to 225 - September 2022 Bank Rate increased to 225 - September 2022.

Bank Of England Makes Biggest Rate Rise Since 1995 Fox Business

How Will The Bank Of England Base Rate Rise Affect You Newschain

Central Bank Watch Boe Ecb Interest Rate Expectations Update

Bank Of England Says Inflation Will Hit 11 After Raising Interest Rates To 13 Year High As It Happened Business The Guardian

Bank Of England Hike Interest Rate By Half Point To 2 25 Bloomberg

Bank Of England Poised To Raise Interest Rates To Pre Covid Level Financial Times

United Kingdom Interest Rate Uk Economy Forecast Outlook

The Bank Of England Must Weather High Inflation And Meddling Politicians The Economist

Why Have Interest Rates Been Slashed And What Will The Impact Be The Independent The Independent